Net operating income (NOI) is a critical metric for evaluating real estate investments. It's the amount of cash flow generated by rental properties before accounting for taxes and other expenses, and it's one of the most important factors investors consider when deciding whether to buy or sell a property. Understanding NOI can help you make more informed decisions about your real estate investments, so let's take a closer look at what it is and how to calculate it.

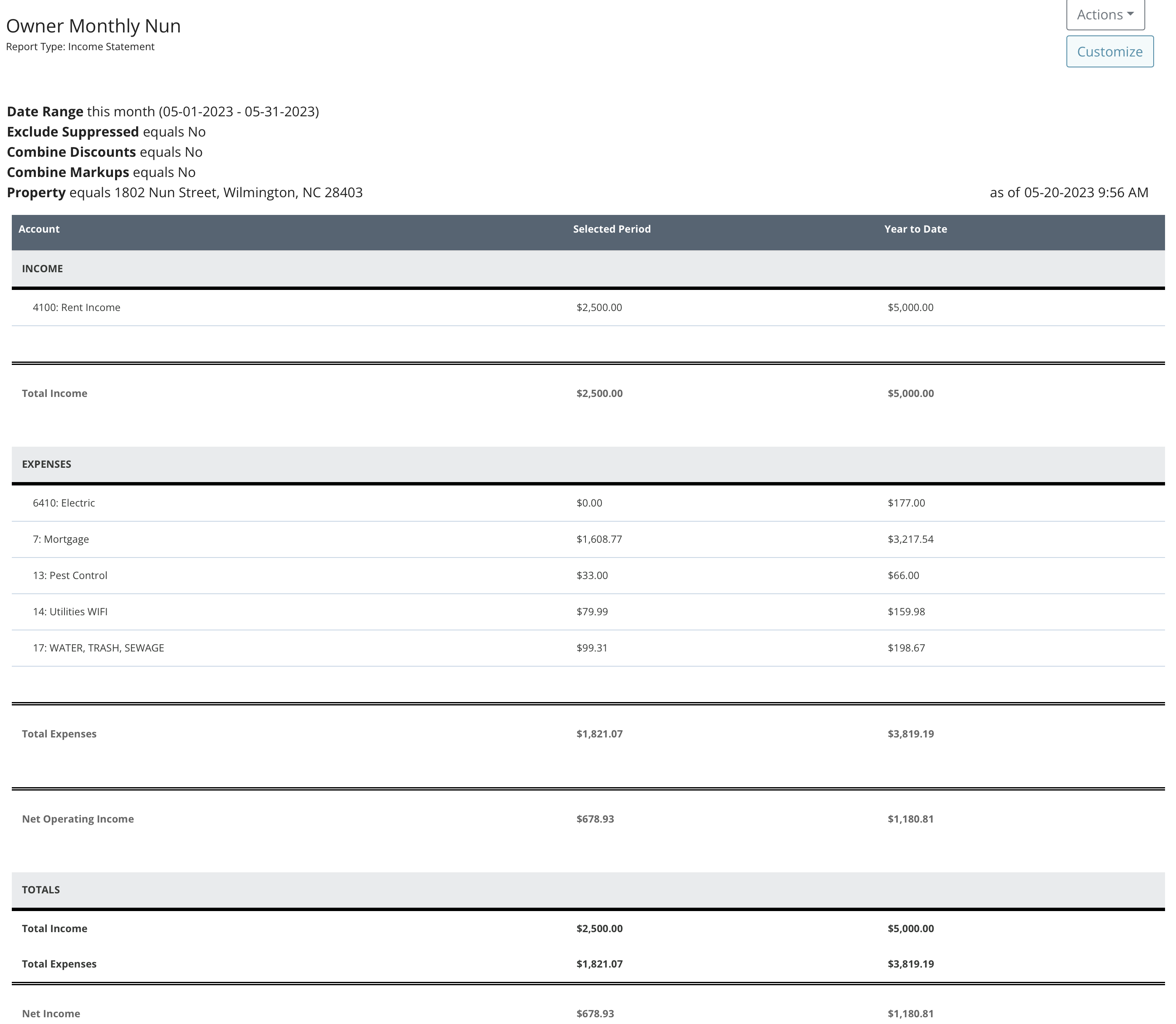

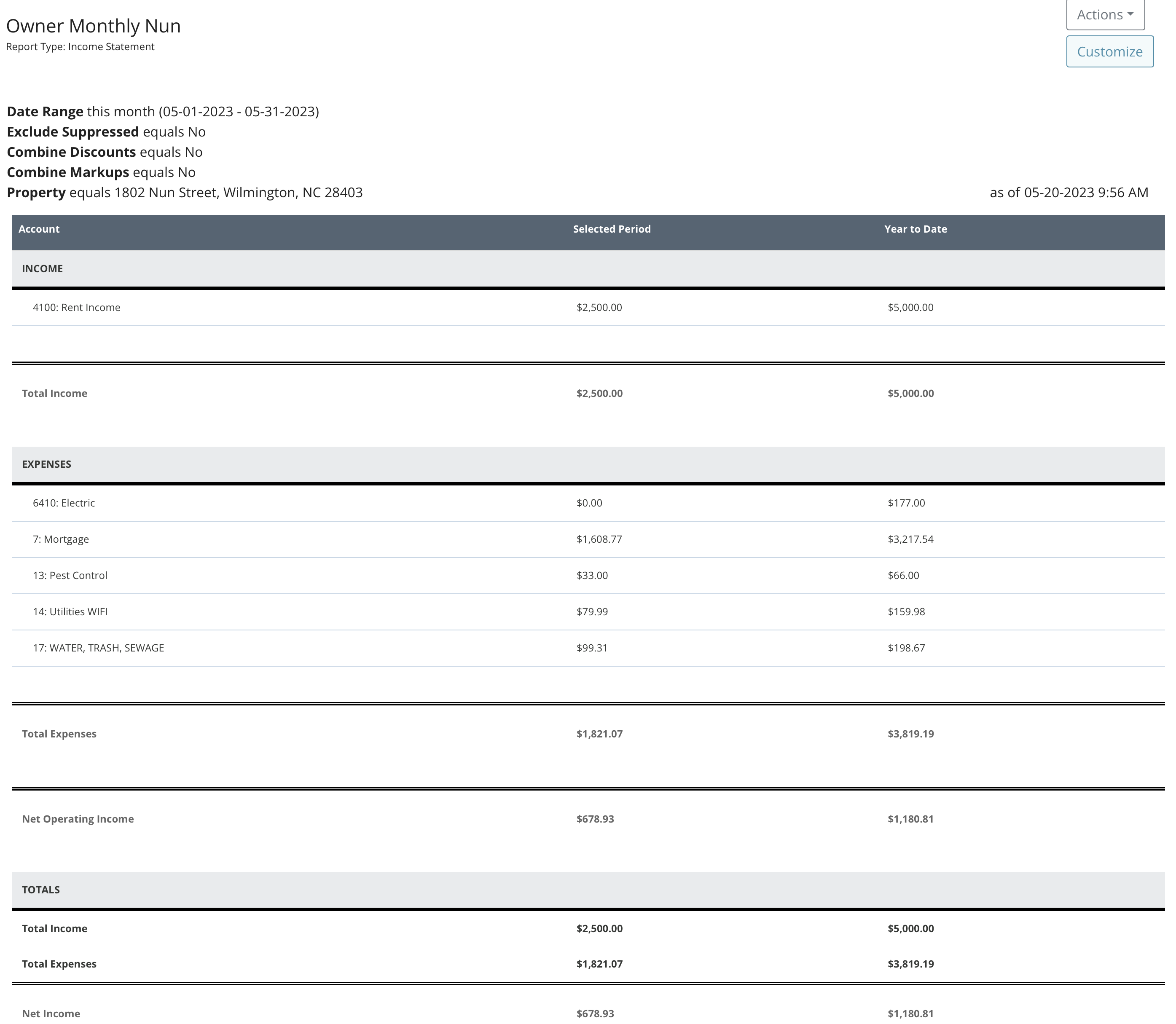

NOI is calculated by subtracting all operating expenses from the property's gross income. Operating expenses include things like insurance, taxes, utilities, maintenance costs, and even wages for on-site personnel. These expenses vary depending on the type of building and its location. To calculate NOI:

1. Add up all of the property's income streams. This includes rental income, laundry money, and any other sources of revenue generated by the building.

2. Add up the operating expenses associated with running the property. These could include insurance costs, taxes, utilities, and more.

3. Subtract the total operating expenses from the total income to get the NOI.

Though understanding the NOI is important, many landlords and property owners also need to know how to control their expenses and maximize profitability. Having detailed records of your expense is key.

1. How do you track expenses and income, including rent payments, taxes, and insurance premiums.

2. How do you manage day-to-day operations, such as collecting rent, handling maintenance requests, and scheduling inspections.

3. How do you find the best tenants, negotiating leases, and managing tenant relations.

4. How do you promote your properties online and through traditional marketing channels, such as print advertising.

You can either tackle this all yourself or hire a professional management team to streamline and manage your investment(s), better serve their clients (tenants), and gain a competitive edge. At the end of the day, it’s all about finding the management company to work for you and and grow your investment.

So get started by calling us today, when it comes to growing your bottomline we have a green thumb.

Below is your basic monthly income statement.